Thoughtful / 24-06-2022

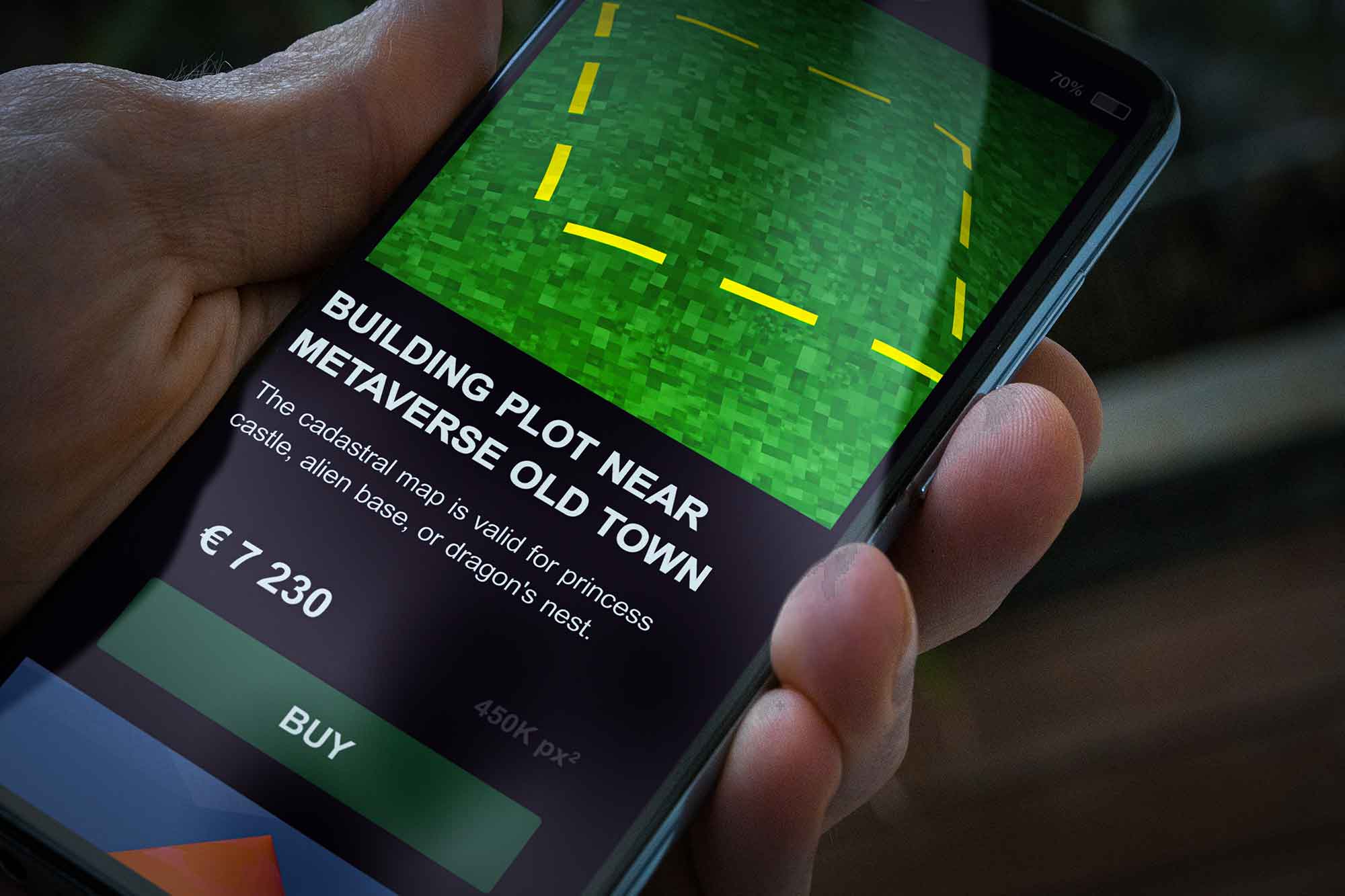

And just like in the real world, the land available for construction is limited – at least in the case of the four best-known metaverses Sandbox, Decentraland, Cryptovoxels and Somnium. The platforms explicitly offer finite spaces. Altogether, there are just a few hundred thousand plots available in these particular worlds – comparatively few for what is supposed to be an infinitely large virtual space.

Neighborhood comes at a price

It may be precisely this restricted supply that creates significant demand. It is rumored that a buyer paid USD 450,000 for the plot next to rapper Snoop Dogg’s virtual property – a simulation of his real mansion. Blockchain technology, which is known to be unforgeable, and so-called NFTs (non-fungible tokens) ensure that properties remain unique and cannot be sold more than once. Thanks to the tokens, virtual ownership of an object or property can also be reliably identified.

Landlord, tenant, buyer and seller: the metaverse is populated with all the players who make the property market work in the real work. In fact, some real estate agents are already specializing exclusively in the brokerage of virtual properties. This is a market that “traditional” property investors should by no means underestimate or sneer at. According to technology company MetaMetrics Inc, the metaverse transaction volume stood at around USD 500 million in 2021. To put this in context: CBRE puts the value of all medical centers, hospitals and rehab clinics that were traded in Germany in 2021 at EUR 508 million. In 2021, virtual properties were thus just as sought-after as real assets within a booming real estate asset class in Germany, the world’s second-largest real estate market.

Virtual properties are expected to crack the billion-dollar mark in 2022, and there’s a lot of talk about metaverse real estate markets as the next big thing. One of the co-founders of the Sandbox platform compared the state of the metaverse a year ago to Manhattan in the 18th century: lots of construction land, few buildings.

Today, companies such as Dolce & Gabbana, Gucci and Philipp Plein are pushing into the Metaverse to use locations for events like virtual fashion weeks. Has the development of hundreds of real years been time-lapsed into one metaverse year? Would anyone in the 18th century have suspected that Manhattan would one day be an extremely important and attractive real estate location?

Right now, the risk is still too high

However, as we know, the (real) world has changed dramatically since the beginning of the year, which seems to be rubbing off on the virtual world and hence on virtual property trading. Between January and June 2022, the Roblox share, for example, one the most prominent metaverse platform operators, dropped by 75 percent. With trading activity in NFTs depicting works of art or other items also plummeting since the beginning of the year, there are clear parallels with the dotcom bubble in the early 2000s.

There are also general technological and location risks, as metaverses under development are competing for the favor of users. A drop in the number of users of a particular platform is likely to have an impact on the property values. This is no different from the situation in real German city centers, which are affected by migration trends and declining footfall.

On top of this, there are technology-related issues. What happens to properties if a platform has to fold and withdraw from the market altogether? Or conversely, if a platform abandons the contrived shortage of supply and creates additional plots? Moreover, standard metaverses are still far from offering the kind of sensory “experience” that Mark Zuckerberg, at least, envisions. If the owner of a virtual property does not make a profit on his investment while the technology is still considered state-of-the-art, there is a risk that values will drop.

Rather than a Manhattan-style departure, this may well be a case of “the next big don’t know”, as Brand Eins recently put it. At present, risks and potential volatility are just too high for most “traditional” real estate investors. Or rather, the balance between opportunities and risks is not even remotely similar to that of physical real estate.

A serious technological core will persist

Brand Eins also wrote, “Of course, a lot of people are jumping on the bandwagon now, hoping to make a quick buck.” However, in the end, a serious core may persist and a stable market for virtual spaces and real estate may well emerge in the medium to long term. There is another parallel to the dotcom crisis: While the companies and their products have largely disappeared from the scene, the underlying technologies have survived in the long term and constitute an important backbone of our daily communications today.

Hence, there is no good reason to shy away from virtual real estate investments altogether. Whatever happens, Mähren AG will be keeping a close eye on developments – and who knows, perhaps in ten or 15 years we may also hold a digital real estate portfolio.